I beg to differ.

The IMF was established in 1945 and the primary function of the IMF was initially to help countries manage the exchange rates of their currencies. Keep in mind that between 1945 and 1971 the world followed a system whereby the exchange rates of currencies were mostly kept constant or were managed at certain levels.

After 1971, when Richard Nixon “stepped-off” the gold standard, the exchange rates of currencies were mostly allowed to float (change). Since then the primary function of the IMF has changed, and today the IMF provides loans to countries that struggle with Balance of Payments (BoP) difficulties.

A payment balance “problem” occurs when a country must repay a loan in a currency that is not its own, or where a country must pay for imports in a foreign currency of which it does not have enough off. The IMF could, under these circumstances, and under strict conditions, provide loans to qualifying countries.

Keep in mind that an IMF-loan cannot be used to pay, for example, government employees’ salaries. Despite the fact that the IMF won’t allow it, the IMF typically lends money in USD$ and not in a country’s domestic currency. IMF loans can only be used for transactions that relate to transactions where other countries are invoiced, like paying-off foreign denominated loans and for imports.

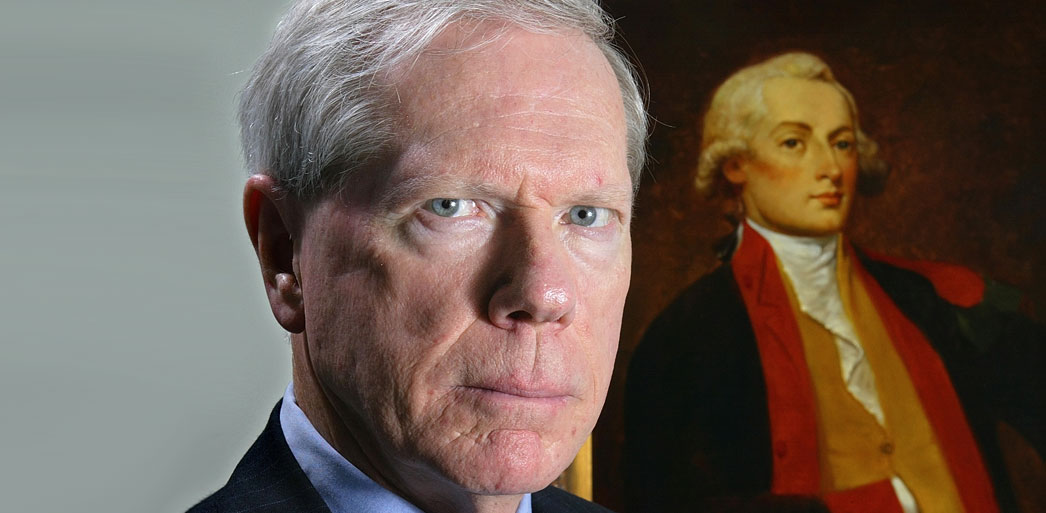

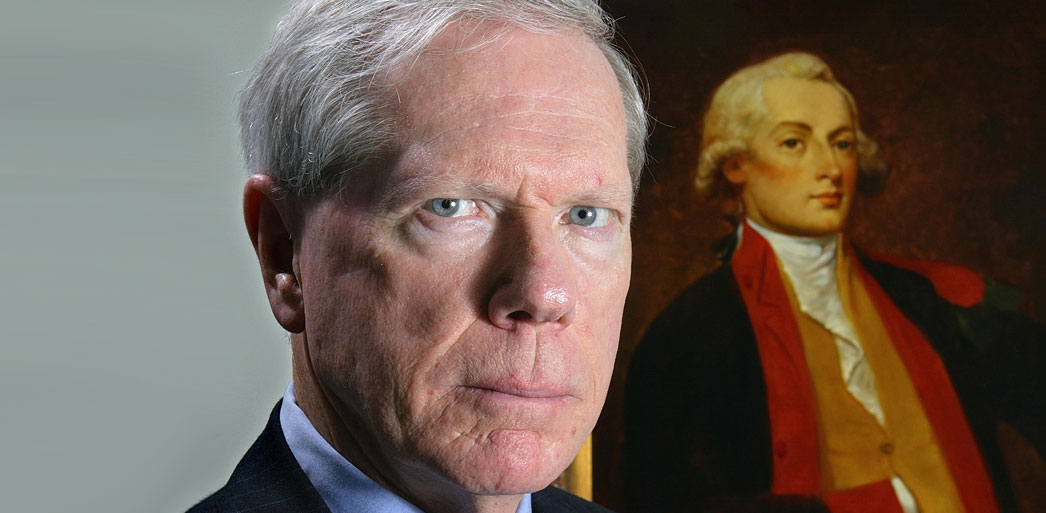

By the way, the last time SA used an IMF loan, Dr Chris Stals was the governor of the Reserve Bank. That loan was used to pay for the import of maize at a time when South Africa’s total reserves were but a fraction of what it is today.

We are in deep financial trouble today because of the financial mismanagement by our government which has finally caught up with us, but the state’s debt problems are mostly denominated in rand and, fortunately, not in foreign currencies.

The state’s total outstanding debt is currently at a record high and each week the mountain of debt gets bigger and bigger. Total outstanding state debt is currently equal to approximately 58 percent of GDP, and that doesn’t even include the debt of parasitical institutions like power utility Eskom!

Bar a small miracle, it’s almost impossible for the state to escape from this spiral of debt. The only realistic solution is for government to dramatically reduce costs by retrenching tens of thousands of “workers”, or at least by freezing government employees’ salaries. But we all know how Cosatu will react if a bunch of unproductive state employees gets laid off…

But there is a tiny light at the end of the tunnel, kind of. The total outstanding gross debt, excluding Eskom and the other bankrupt ones, is around R2 800 billion. Of this amount, R290 billion worth of loans, or just a bit more than 10% of the total debt, was borrowed in the currency of another country – mostly US dollars.

These different loans must be repaid over the next 20 years or so, of which relatively large amounts, around US$2 billion each (currently equivalent to approximately R30 billion), has to be repaid only in the fiscal years 2025/26 and 2028/29. Over the next few years relatively small amounts must be repaid.

In the meantime, the Reserve Bank holds approximately R700 billion in foreign currency denominated reserves (of which approximately R80 billion in gold). In terms of agreements between the Reserve Bank and the Treasury, reserves that had their origins in foreign denominated loans of the state, can only be used to repay foreign loans of the state when they eventually fall due.

Clearly there are more than enough foreign reserves at the Reserve Bank to cover all the state’s foreign denominated loans at once – which is obviously not necessary.

That’s not all. Banks are also actively involved in the taking (deposits) and lending of foreign denominated loans. In total, South African banks hold in excess of approximately R200 billion more in foreign denominational assets (loans) than in foreign denominational deposits (liabilities).

In total the Reserve Bank and our banks have access to approximately R1 000 billion in the form of foreign denominated assets.

This doesn’t mean that South Africa can simply, and easily, finance all possible capital outflows. Foreigners own a lot of rand denominated liquid assets, like state debt instruments, in South Africa. Additionally, South Africa runs a chronic deficit on our current account. This means that South Africa is constantly “losing” foreign currency.

If many foreigners should decide to sell their (liquid) assets in South Africa, it will undoubtedly cause many problems when they convert these rands into, say, US$. But because the Reserve Bank follows a policy that allows foreigners relative freedom to take capital in and out of the country, the exchange rate of the rand will take a knock if foreigners en masse decide to sell their rand denominated assets – something that happened recently.

Should the Reserve Bank, however, decide to actively protect the exchange rate of the rand by selling foreign reserves and buying rands in the market, which is not currently the case and which is not policy, a depreciating exchange rate will serve as a shock absorber during times of large capital outflows.

We are certainly sinking ever deeper into a debt morass, but it’s mostly rand denominated debt. For this reason, we can expect further tax increases, prescribed assets, and further pressure on the Reserve Bank to relax monetary policy.

There is one good reason why an IMF loan can come in useful, and that is to use such a loan as an excuse to push through certain politically difficult structural changes. But in as far as it relates to paying back scheduled foreign loans or for imports, South Africa has more than enough foreign reserves.

Additionally, a floating exchange rate can also cushion us against excessive capital outflows in the short term.

All this means that we won’t need an IMF loan, at least not soon.