South Africans owe Lesetja Kganyago, governor of the South Africa Reserve Bank (SARB), a huge debt of gratitude. Kganyago defended the independence of the SARB quite successfully last year after a politically inspired attack.

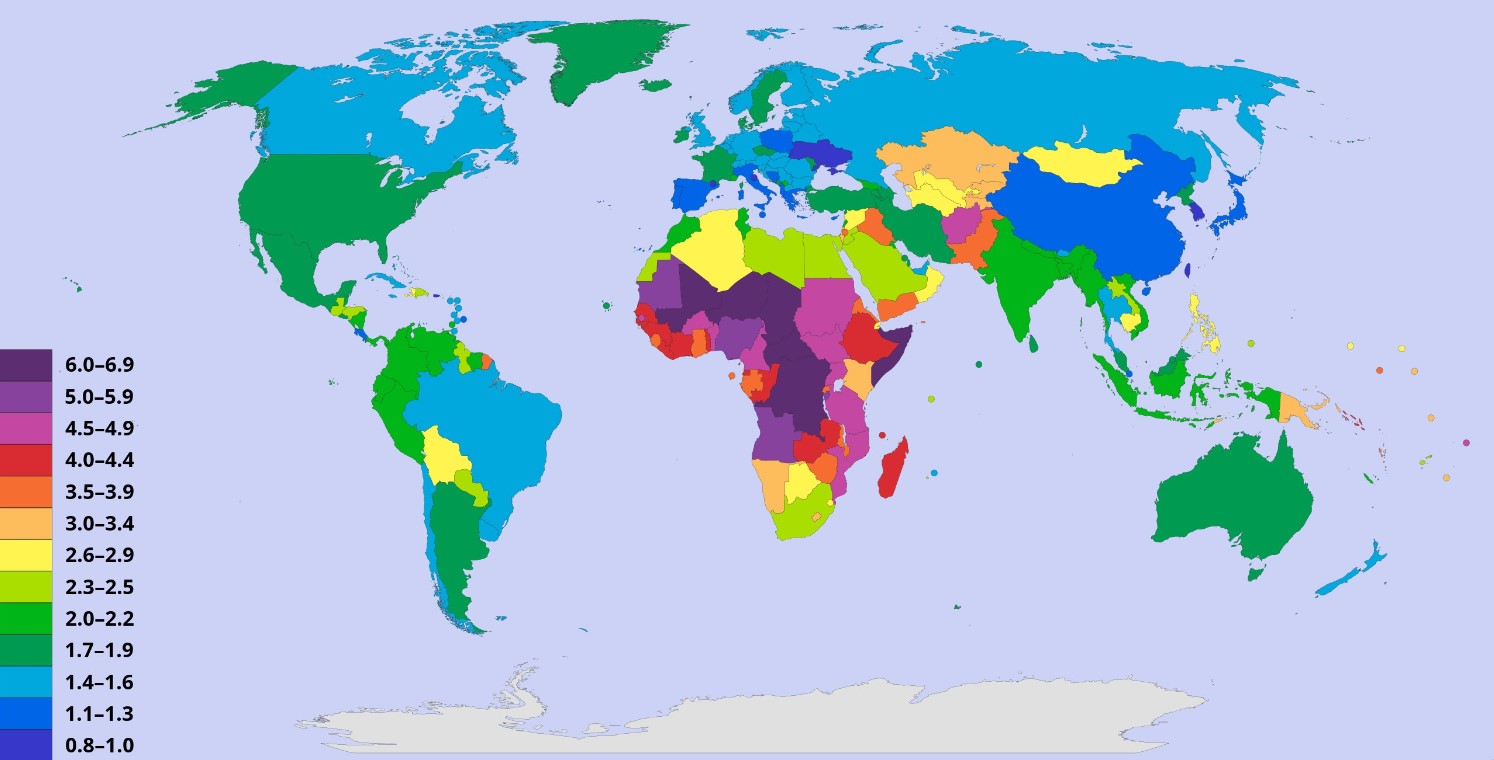

Additionally, the lower inflation rate at the end of 2019 proves that he was also successful in his primary objective of protecting the value of the currency. But even more importantly, future inflation expectations are also slowly “drifting” lower which shows that the SARB succeeded in its endeavour to “manage” inflation expectations lower.

Although the official inflation target of the SARB remains between 3 percent and 6 percent, they recently announced that 4,5 percent is their preferred target. Markets didn’t really believe this but at the end of last year inflation reached its lowest levels in many years. It’s even possible that the inflation rate can fall to below 3 percent.

This strict monetary policy approach supported, amongst others, a stronger rand the last couple of months, and this could last for a while still. The South African financial markets are also particularly attractive in terms of valuations. Even if we are downgraded, something I’m strongly suspecting, the rand and our financial assets may just perform well in 2020. This is good news because the SARB then has room to cut interest rates.

So, to conclude, the good news: expect a strong rand and a nice run on our (especially financial sector) assets and the capital market.

And now for the bad and even worse news.

The same record is still playing. The mismanagement of especially Eskom, and the subsequent limited supply of electricity, means that the rate at which the South African economy can grow is severely constrained. I expect an economic growth ceiling of approximately 1 percent which means that growth could be lower but unlikely to exceed 1 percent.

Onto the “state’s” dire finances. The (central) state’s debt is at a record high and rising fast, while our beloved Eskom alone owes more than R500 billion. The rest of the SOE’s are also mostly mismanaged while the finances of the local authorities are at a similar state of collapse.

I think we can safely say that the “state” is in the process of collapsing.

In order to stabilise the states’ finances, only two options are available; limit state spending (expenses) dramatically or increase the state’s revenue (more taxes), or a combination of the two.

The downside: any of these two options will reduce the stimulatory effect of the fiscus and hence will further stunt economic growth in the short term. And can we look at minister Tito Mboweni to deliver the goodies in next month’s budget? I expect that he will try to limit the state’s spending, as well as try to increase revenue through higher taxes.

I believe Mboweni is the best man for the finance portfolio, but he faces enormous odds. The ANC’s raison d’être is to seize the state in order to feed and maintain its own massive patronage. Without consistent high state spending, the ANC simply loses its reason for existence. So, it’s unlikely that a significant reduction in state spending will be possible at all. I’m also not holding my breath that Mboweni will last that long as the minister of finance…

So, what can be expected on tax proposals? I have no doubt that several taxes will be increased. My only uncertainty is whether VAT will also be increased and by how much personal income tax will be increased. A VAT increase, which is the least damaging option, is politically almost impossible while higher personal income tax will be much easier to implement.

But since a reduction in spending or an increase in taxes will weigh on economic growth, in the short term, the 1 percent “ceiling” (compliments of Eskom) will be reduced even further.

Then there is also the very likely possibility of other stupidities. Further steps are likely to be implemented to follow through on the planned National Health Insurance – which is in anyway doomed to failure – prescribed assets may come a step closer and an increase in forex controls is also possible.

And this just further entices the downgrading-sword hanging over us. Not that a downgrade should make much of a difference, I believe that much of the bad news has already been priced into the markets.

Back to the 1 percent ceiling; perhaps we may consider ourselves lucky if we even reach this. In an environment where the population is growing at more than 1,6 percent, it’s unavoidable that unemployment and poverty will increase yet again.

No comments.

By submitting a comment you grant Free West Media a perpetual license to reproduce your words and name/web site in attribution. Inappropriate and irrelevant comments will be removed at an admin’s discretion. Your email is used for verification purposes only, it will never be shared.