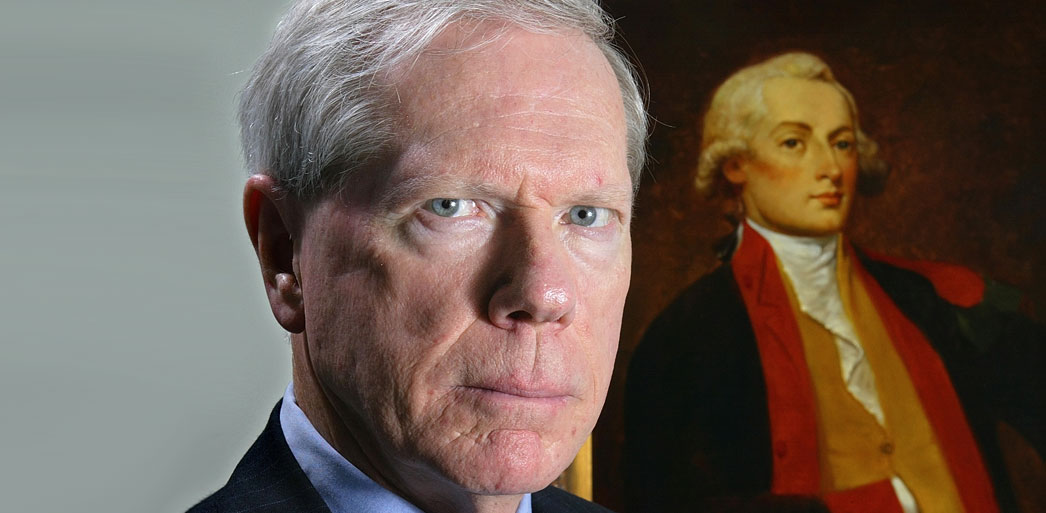

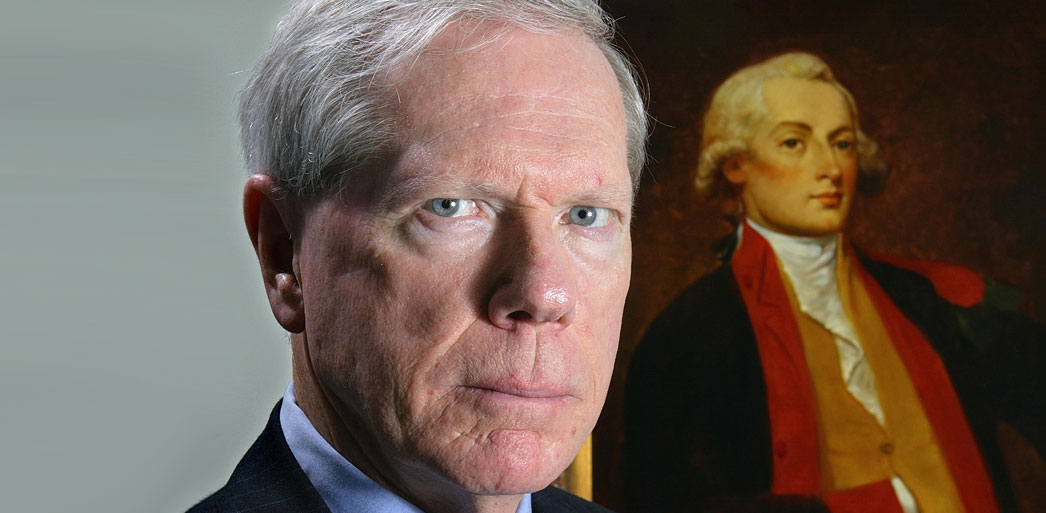

Sure, there was a change of guard. Zuma was just the symbol of corruption, incompetence and state capture. We may have a new president, but it is still the same ANC. Judging from president Ramaphosa’s actions so far, he must either be weak, doesn’t appreciate the danger in which the South African economy is, or he simply doesn’t care.

I think we have a weak president that simply doesn’t have the political capital to implement unpopular structural changes. All that is left for him to do is to use (gutted) institutions, like the NPA, to do the heavy lifting for him. He is playing the “long-game”, but this economy doesn’t have a long time.

Even if we can somehow wave a magic wand and get rid of all the corruption and incompetence in the state and SOEs overnight, the perilous condition of the state’s finances will need an extraordinary attempt to save us from further economic collapse.

The fiscal deficit (“fiscal” is derived from the same Latin word that means basket in which money [tax collections] is kept) is the difference between what the state (usually defined as the “national government”) spends minus its revenue (taxes). This deficit is the amount of new money the state needs to borrow and is usually expressed as a percentage of GDP.

Here’s a party trick; take the fiscal deficit to the GDP of a country for a period (usually a fiscal year) and subtract the rate of economic growth from this number. What is left is roughly how many percentage points the state debt-to-GDP will increase.

For example, our fiscal models suggest that the fiscal deficit in the current fiscal year (2019/20) is probably going to be around 6%. Fiscal years start from 1 April every year. State debt as a percentage of GDP at the start of this fiscal year was 56,7 percent. We expect economic growth for the current fiscal year to be approximately 0,5 percent, but for simplicity’s sake, let’s call it 1 percent.

Now, the trick continues: 6 percent (the deficit:GDP) minus 1 percent (GDP-growth) gives you 5 percent, which is the rate at which the fiscal debt to GDP will increase this year. Add the 5 percent to the existing 56,7 percent of state debt and we will end the fiscal year with debt of approximately 62 percent. There are a few other variables that will also affect this ratio, but for a simple back-of-matchbox calculation this simple model will suffice.

Now, repeat this process for the next number of years. Not pretty… That is the reason why state finances find itself in such a death-defying spiral; because, especially since 2009, state spending was increased relentlessly at a time when tax collections collapsed – mostly because of a faltering economy. At this rate of debt increase, it is very clear things will turn out very unhappy, very soon.

In order to fix the problem of collapsing fiscal accounts, a combination of three things must happen to stabilise the debt to GDP ratio. The first thing is that the economy should preferably start growing at a rate of 6 percent, at which rate the debt to GDP ratio will stabilise.

Unfortunately, the ruling elite seems to be hell-bent on doing even more damage to the economy with all sorts of silly socialist ideas, like the suggested creation of yet another state bank, a new mandate for the SARB and the unaffordable NHI. Because of this, economic growth, believe me, will not save us from this fiscal cliff.

A second option is to increase taxes by the equivalent of 5% of GDP (current market price), which is approximately R250 bn! For example, VAT needs to increase by more than 11 percentage points to get this kind of money, or personal income taxes need to increase on average by nearly 10 percentage points! This is a meaningless argument because such an increase in taxes will have a huge adverse effect on growth and overburdened taxpayers will not be happy with this. But the magnitude of required tax increases is clear.

Preferably, and the only realistic option left, is to cut state spending with a similar amount: R250 bn. Percentage wise that is a real reduction in state spending of approximately 15 percent, or 20 percent in nominal terms! Now, show me the politician with the clackers to go and give COSATU the good news! But even if we could implement such austerity measures, the initial impact on the economy will be hugely negative – dammed if you do, dammed if you don’t.

But wait, there is more. We all know that SOE’s are make-believe creations that pretend to be companies, with boards, chairs and all the perks that go with that. When push comes to shove, then suddenly they have a “shareholder” (read the taxpayer) that needs to keep bailing them out, very un-company like!

If the debt of SOE’s are also added to that of the state, as it should be, then state debt to GDP will reach approximately 72 percent by the end of this fiscal year. And we haven’t even mentioned local authorities, the Road Accident Fund, the deficits at the GEPF …

Clearly, we are in trouble. The troughing of socialists like this always ends the same and here’s what happens next:

First you (read the government) run out of taxpayers. The taxpayers that haven’t emigrated yet, are carrying a huge tax burden and any further increases in taxes will likely have a detrimental effect on actual tax collections.

Then you turn your attention to those assets under your control, like the SOE’s. But eventually you also run out of assets to plunder, like Eskom, SAA, SABC…

Then you turn your attention to the next target, the few pots of gold left, the savers. Savers are those people that save for retirement, for example, and a glance towards the shenanigans at the PIC is proof of what happens to the assets of the savers. In the meantime, prescribed assets are also suggested, which will exacerbate the plight of our dwindling number of savers. Also keep in mind that any tax on capital is in a way also a confiscation of savings. Other measures are also typically taken by now, like forex controls. All this happens until you run out of savers.

But none of this will prevent the inevitable: debt will continue to balloon, the economy will falter, poverty and unemployment will keep going up and those that are responsible for all the troubles will keep on blaming “the others” for their absurdities.

By then the only remaining alternative will be to inflate your debt away. But for that to happen you need to control the SARB and with Lesetja Kganyago at the helm, that is not going to be easy. But be assured, as we sink further into this debt chaos the pressure on the SARB will become relentless and eventually also the SARB will buckle under the pressure. And then, inflation!

But it can be different.

What we must understand is that no structural adjustment, no new dawn, no fresh start can be taken seriously unless it includes an admittance that there are just too many trying to live off too few. Many tens of thousands of civil “servants”, including those at SOE’s, are simply not needed. They must go!

The question: Are our democratic institutions strong enough to confront our economic woes, even if it means confronting political ideologies and political allies? Will the president call on the police and the army, if necessary, to protect us from a marauding wave of sabotage and destruction when an overweight, overpaid and underworked civil “service” realise that the party is over? Or will we just become another socialist failure?

With these kinds of odds, can we blame the dwindling number of wealth creators to hedge their bets, to reduce their workforce, to expatriate their wealth and to “wait and see” before they commit to SA?

I don’t think so.

2 comments

The problem is not the ruling ANC government, it is the electorate that is either captured by the ANC or just to dumb to make the correct decision during elections.

Democracy has failed in South Africa, just as in most other African- and third world countries. Democracy is based on western culture and value system. It will never work in SA or any other African country.

So just prepare yourself for state failure, no matter what.

Thats said, why do minority groups like the Afrikaners have to go through this if they can realize the right to self-determination as stated in the RSA constitution ss235 ? Actually this could be the only chance of Southern Africa ever rising out of poverty by protecting and incubating as core section on highly skilled and committed people to assist in the future African Renaissance when the time is right . #235

A clear observance of how they are too many unqualified people in control of Governance who are earning disgracefully enormous and undeserved salaries. And most of them do nothing for our country, and greatly contribute to corruption, unrest and an enormous depletion of our State coffers.

By submitting a comment you grant Free West Media a perpetual license to reproduce your words and name/web site in attribution. Inappropriate and irrelevant comments will be removed at an admin’s discretion. Your email is used for verification purposes only, it will never be shared.