A new financial world is born

Even if this is not the birth of a new world order, at least it will be the birth of a new financial one. Such a turning point was proclaimed by Zoltan Pozsar, interest rate strategist at the major Swiss bank Credit Suisse, in a widely acclaimed paper of March 7 entitled “Bretton Woods III”.

Published: April 17, 2022, 3:22 pm

Pozsar is not an outsider. In his position at the New York Federal Reserve and as an advisor to the US Treasury Department, he had insight into the background and processes behind the great financial crisis of 2008. He knows the strengths and weaknesses of the dollar system. The foundations of this system, he noted, crumbled when the West confiscated Russia’s foreign exchange reserves.

Why is the freeze on Russia’s foreign exchange reserves a game changer?

Freezing, or rather confiscating, Russia’s foreign exchange reserves annuls the rules of procedure of Bretton Woods I and II, namely the security and availability of foreign exchange reserves. Unlike gold, the dollar and euro are not physically tangible – apart from cash – but only booked on the computers of the Western banking system.

In China’s case, it’s the equivalent of $3 400 billion. India has accumulated 632 billion, Saudi Arabia 441 billion. In the worst case, could these funds also be blocked and thus become useless? Of course. After all, US President Joe Biden has already described the Saudi monarchy as a “pariah country”. So it makes sense to increasingly decouple Chinese, Arab and Indian foreign trade, not to mention Russia, from the dollar.

Whether it is correct to announce a new monetary world order as a Bretton Woods III, remains to be seen. Either way, the world has become multipolar, ironically because of the Biden administration’s short-sightedness. Bretton Woods I, named after a conference in New England at the end of the Second World War, established the hegemony of the dollar and at the same time underpinned the world power position of the USA.

America went from creditor to debtor

The US currency was linked to gold and exchangeable for gold at any time foreign central banks deposited their dollars in New York. The dollar was gold-backed money – until August 15, 1971, when President Richard Nixon broke the treaty, refused to pay and ended convertibility.

Bretton Woods II followed, with the inflation and currency chaos of the 1970s, with two decades of stabilization, with new American wars after the turn of the millennium, and with the near-death of the system in the 2008 financial crisis. But even without gold backing, the dollar remained the world’s leading and reserve currency. The arrangement allowed Americans to permanently live beyond their means, to have wars and consumption financed from abroad. The budget deficits and the deep-red trade balance went unpunished.

America, once the world’s creditor, became its debtor. The government debt of the “wealthy” country was recently at a fantastic 30 trillion dollars. The fact that the dollar has been appreciating against the euro for years is not a sign of quality, but is due to the fact that the euro is an open-ended experiment, not an established currency. Both are heading into a commodity-induced tsunami of inflation this decade, against which the monetary debasement of the 1970s might look like a mediocre event.

France repatriates gold

In 2013 the German central bank was the first to announce it would repatriate gold from France as well as the Federal Reserve Bank of New York. After Germany, other countries such as the Netherlands and Austria followed by repatriating the precious metal.

France’s central bank sees a huge potential for gold, expecting it’s role in the financial system to increase. “Why else upgrade all the French gold, overhaul the vault, set up a new IT system, and develop a full set of trading services for foreign central banks in Paris?” said Jan Nieuwenhuijs, gold analyst.

The core element of the Chinese strategy

Zoltan Pozsar makes an important distinction: that between inside money and outside money. The first is the money at the center of the global financial system, the dollars and euros circulating in the USA and the EU that can be multiplied at will. Outside money is the money of the countries on the periphery, which, in addition to Russia, also includes China, India and other emerging countries. Almost unnoticed by the public, the Brazilian real has appreciated by 20 percent against the euro, the Chinese yuan by almost nine percent and the South African rand by almost seven percent in the past twelve months.

Dethroning King Dollar is undoubtedly a core element of China’s strategy. As early as 2020, the People’s Bank of China was the only major central bank that failed to open the money floodgates because of Corona. It decided to maintain a strict monetary policy. Now the People’s Republic has the unexpected opportunity to buy and hoard Russian raw materials – especially oil – at far below world market prices and thus strengthen the resilience of the Chinese economy. Beijing will come closer to the goal of a multipolar currency order, perhaps also with the introduction of a digital yuan.

US share of world trade falls

There will be Saudi oil sales against yuan, Chinese oil imports against rubles and a gradual switch from the American-controlled payment system Swift to the already established Chinese counterpart. That will not happen overnight, after all it took a while for the British pound to give way to the American dollar. The oligarchs of the periphery must be extremely worried after they witnessed how the foreign assets of the Russian billionaires were practically expropriated overnight without any legal basis. They will want to diversify as soon as possible.

History has shown that ultimately, political and financial power relations always follow economic clout. The signs point to a multipolar world order, possibly also – after an inflationary collapse – to a monetary reorganization with money backed by commodities or gold, spelling the end for the only current world power.

Although 40 percent of international trade in goods is still invoiced in dollars, America’s share of world trade has fallen to less than 10 percent. In 1960, the USA accounted for 40 percent of the world’s gross domestic product. Now it’s less than 16 percent. In the world of tomorrow, EU policies, which are currently aimed at the destruction of Germany’s industrial base, are not the answer.

All rights reserved. You have permission to quote freely from the articles provided that the source (www.freewestmedia.com) is given. Photos may not be used without our consent.

Consider donating to support our work

Help us to produce more articles like this. FreeWestMedia is depending on donations from our readers to keep going. With your help, we expose the mainstream fake news agenda.

Keep your language polite. Readers from many different countries visit and contribute to Free West Media and we must therefore obey the rules in, for example, Germany. Illegal content will be deleted.

If you have been approved to post comments without preview from FWM, you are responsible for violations of any law. This means that FWM may be forced to cooperate with authorities in a possible crime investigation.

If your comments are subject to preview by FWM, please be patient. We continually review comments but depending on the time of day it can take up to several hours before your comment is reviewed.

We reserve the right to delete comments that are offensive, contain slander or foul language, or are irrelevant to the discussion.

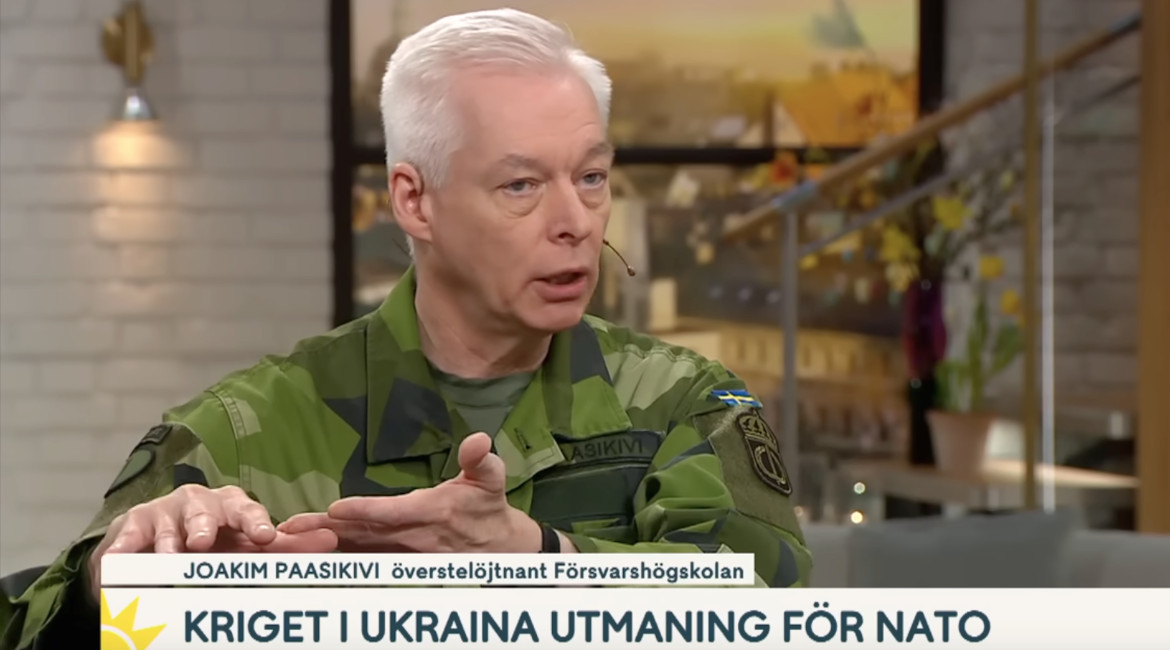

Swedish military wants to remilitarize the Åland Islands

The demilitarized autonomy has previously been known as 'the islands of peace.

NOAA Predicts Zero Sunspots for Almost the Whole 2030s

CLIMATEThe United States' government scientific organization, the National Oceanic and Atmospheric Administration (NOAA), predicts zero sunspots from 2031 to 2040. This is an extreme situation that has not occurred in as long as humanity has been counting sunspots, and it leads us into uncharted territory in terms of our solar system. However, this prediction aligns with the warnings of the world-renowned solar researcher Valentina Zharkova for many years, who indicated in 2019 various signs of this catastrophic phenomenon, including the extreme hailstorms we have seen in Europe and the world this summer. The forecast and various observations this year give cause for very significant concern. In this unique analysis, Free West Media explains why.

European Nationalist Parties Forge Cooperation Ahead of EU Elections

EUROPEAN ELECTIONSOn Saturday, August 26, representatives of six European nationalist parties gathered in Budapest. The meeting was initiated by the Hungarian party Mi Hazánk and took place in the national parliament. Representatives of the parties signed a joint declaration that not only reaffirms the parties' friendship but also their unity on a range of complex political issues. A surprisingly clear and radical manifesto was established. The hope is that this cooperation will lead to success in the EU elections and eventually result in the formation of a group in the European Parliament. For Swedish nationalism, this meeting marks a success as Sweden, for the first time, has a party represented in a leading nationalist cooperation in Europe. Free West Media was present at this historic event.

Turkey Believes Sweden Hasn’t Done Enough

Sweden will have to wait a bit longer for NATO membership, according to Turkey's Justice Minister Jilmaz Tunc. First, Sweden must extradite the "terrorists" Turkey wants and stop the desecration of the Quran.

Swedish Weapon Takes Down Russia’s Best Attack Helicopter

The Russian attack helicopter Ka-52 is considered one of the world's best and has struck fear in Ukraine, where it has hunted down tanks and other armored vehicles, often beyond the range of many light anti-aircraft systems. However, it has met its match in the Swedish air defense missile system RBS 70, which has quickly led to significant losses for the Russian helicopter forces.

Strong Confidence in German AfD

Alternative for Germany (AfD) held a party conference on July 29-30 to select candidates for the upcoming EU election next year. EU Parliament member Maximilian Krah, belonging to the party's more radical, ethnonationalist faction, was appointed as the top candidate. The party's two spokespersons delivered powerful speeches criticizing the EU's failed migration policy and trade sanctions that isolate Europe and Germany from the rest of the world. They argued that it's time for the EU to return a significant portion of its power to national parliaments. However, they have dropped the demand for Germany to exit the EU.

The Establishment Wants to Ban Germany’s Second Largest Party – for the Sake of Democracy

The rising popularity of AfD has raised strong concerns within the establishment. Despite lies and demonization in the media and isolation from the overall political establishment, the party continues to grow. Certain representatives of the party are accused of becoming increasingly "extreme," and in an unusual move, the influential weekly newspaper Der Spiegel demanded that AfD be "banned."

Dutch FvD break through the media blockade

What is happening in the Netherlands? It is often difficult to follow events in other countries, especially when distorted by system media. We give Forum for Democracy (FvD) the opportunity to speak out on the political situation in the Netherlands and the staunch resistance they face in trying to save the country.

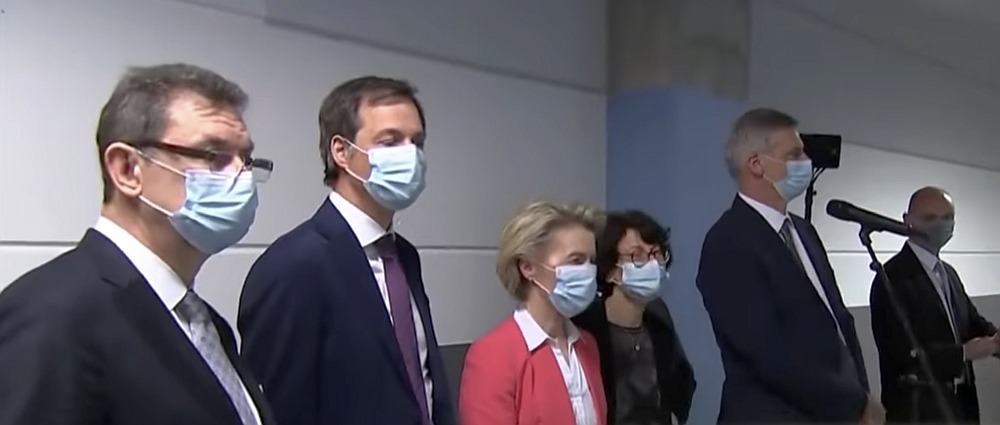

The Ursula von der Leyen Affair

After a criminal complaint in Belgium against the President of the European Commission, the so-called SMS-case, now takes a new turn. The judge responsible for the investigation will likely gain access to the secret messages exchanged between Ursula von der Leyen and Albert Bourla, CEO of Pfizer, at least if they haven't been deleted.

Publisher of Unique Literature Worldwide Blocked by International Distributor

Arktos has distinguished itself by publishing groundbreaking philosophers and social critics. Now, the publisher's international distributor has abruptly terminated the cooperation, and more than 400 already printed titles cannot reach their audience. There is strong evidence that the distributor has been under pressure, something that has also happened in Sweden. We have spoken with Arktos founder Daniel Friberg about the ongoing struggle for freedom of speech in a shrinking cultural corridor.