These three firms own corporate America

A fundamental change is underway in stock market investing, and the spin-off effects are poised to dramatically impact corporate America.

Published: November 22, 2021, 10:57 am

In the past, individuals and large institutions mostly invested in actively managed mutual funds, such as Fidelity, in which fund managers pick stocks with the aim of beating the market. But since the financial crisis of 2008, investors have shifted to index funds, which replicate established stock indices, such as the S&P 500.

The magnitude of the change is astounding: from 2007 to 2016, actively managed funds have recorded outflows of roughly US$1,200 billion, while index funds had inflows of over US$1,400 billion.

In the first quarter of 2017, index funds brought in more than US$200 billion – the highest quarterly value on record.

Democratising the market?

This shift, arguably the biggest investment swing in history, is due in large part to index funds’ much lower costs.

Actively managed funds analyse the market, and their managers are well paid for their labour. But the vast majority are not able to consistently beat the index.

So why pay 1 percent to 2 percent in fees every year for active funds when index funds cost a tenth of that and deliver the same performance?

Some observers have lauded this development as the “democratisation of investing”, because it has significantly lowered investor expenses.

But other impacts of this seismic shift are far from democratising. One crucial difference between the active fund and the index fund industries is that the former is fragmented, consisting of hundreds of different asset managers both small and large.

The fast-growing index sector, on the other hand, is highly concentrated. It is dominated by just three giant American asset managers: BlackRock, Vanguard and State Street – what we call the Big Three.

Lower fees aside, the rise of index funds has entailed a massive concentration of corporate ownership. Together, BlackRock, Vanguard and State Street have nearly US$11 trillion in assets under management. That’s more than all sovereign wealth funds combined and over three times the global hedge fund industry.

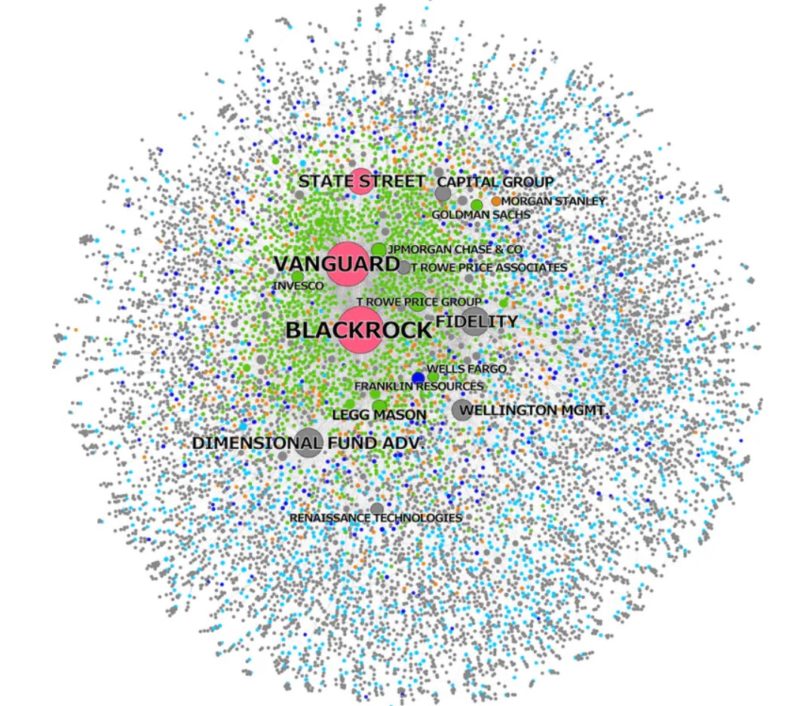

In a recently published paper, our CORPNET research project comprehensively mapped the ownership of the Big Three. We found that the Big Three, taken together, have become the largest shareholder in 40 percent of all publicly listed firms in the United States.

Figure 1: Network of ownership by the Big Three in listed US firms. (See our paper for explanation of colours). Fichtner, Heemskerk & Garcia-Bernardo (2017)

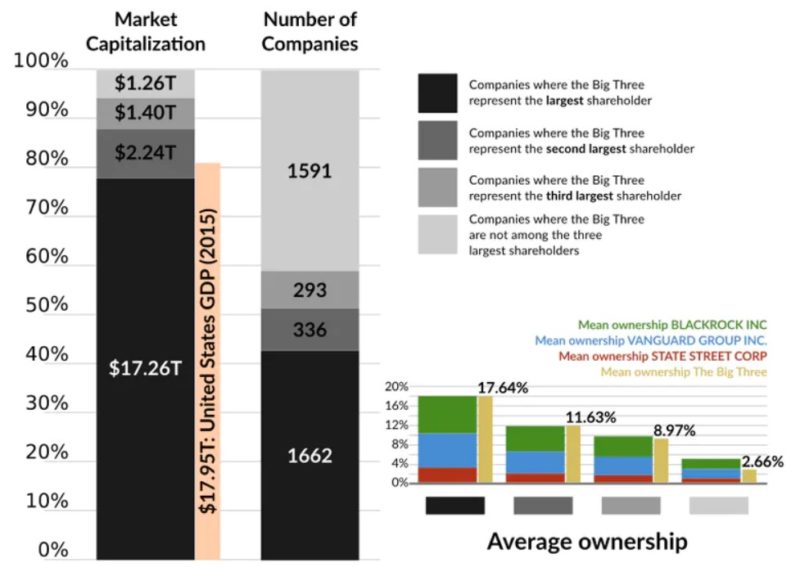

In 2015, these 1,600 American firms had combined revenues of about US$9.1 trillion, a market capitalisation of more than US$17 trillion, and employed more than 23.5 million people.

In the S&P 500 – the benchmark index of America’s largest corporations – the situation is even more extreme. Together, the Big Three are the largest single shareholder in almost 90 percent of S&P 500 firms, including Apple, Microsoft, ExxonMobil, General Electric and Coca-Cola. This is the index in which most people invest.

Figure 2: Statistics about the ownership of the Big Three in listed US firms. Fichtner, Heemskerk & Garcia-Bernardo (2017)

The power of passive investors

With corporate ownership comes shareholder power. BlackRock recently argued that legally it was not the “owner” of the shares it holds but rather acts as a kind of custodian for their investors.

That’s a technicality for lawyers to sort. What is undeniable is that the Big Three do exert the voting rights attached to these shares. Therefore, they have to be perceived as de facto owners by corporate executives.

These companies have, in fact, publicly declared that they seek to exert influence. William McNabb, chairman and CEO of Vanguard, said in 2015 that, “In the past, some have mistakenly assumed that our predominantly passive management style suggests a passive attitude with respect to corporate governance. Nothing could be further from the truth.”

When we analysed the voting behaviour of the Big Three, we found that they coordinate it through centralised corporate governance departments. This requires significant efforts because technically the shares are held by many different individual funds.

Hence, just three companies wield an enormous potential power over corporate America. Interestingly, though, we found that the Big Three vote for management in about 90 percent of all votes at annual general meetings, while mostly voting against proposals sponsored by shareholders (such as calls for independent board chairmen).

One interpretation is that BlackRock, Vanguard and State Street are reluctant to exert their power over corporate America. Others question whether the Big Three really want this voting power, as they primarily seek to minimise costs.

Corporate American monopoly

What are the future consequences of the Big Three’s unprecedented common ownership position?

Research is still nascent, but some economists are already arguing that this concentration of shareholder power could have negative effects on competition.

Over the past decade, numerous US industries have become dominated by only a handful of companies, from aviation to banking. The Big Three – seen together – are virtually always the largest shareholder in the few competitors that remain in these sectors.

This is the case for American Airlines, Delta, and United Continental, as it is for the banks JPMorgan Chase, Wells Fargo, Bank of America, and Citigroup. All of these corporations are part of the S&P 500, the index in which most people invest.

Their CEOs are likely well aware that the Big Three are their firm’s dominant shareholder and would take that into account when making decisions. So, arguably, airlines have less incentive to lower prices because doing so would reduce overall returns for the Big Three, their common owner.

In this way, the Big Three may be exerting a kind of emergent “structural power” over much of corporate America.

Whether or not they sought to, the Big Three have accumulated extraordinary shareholder power, and they continue to do so. Index funds are a business of scale, which means that at this point competitors will find it very difficult to gain market shares.

In many respects, the index fund boom is turning BlackRock, Vanguard and State Street into something resembling low-cost public utilities with a quasi-monopolistic position. Facing such a concentration of ownership and thus potential power, we can expect demands for increased regulatory scrutiny of corporate America’s new “de facto permanent governing board” to increase in coming years.

Jan Fichtner

Postdoctoral Researcher in Political Science, University of Amsterdam

Eelke Heemskerk

Associate Professor Political Science , University of Amsterdam

Javier Garcia-Bernardo

PhD Candidate, University of Amsterdam

All rights reserved. You have permission to quote freely from the articles provided that the source (www.freewestmedia.com) is given. Photos may not be used without our consent.

Consider donating to support our work

Help us to produce more articles like this. FreeWestMedia is depending on donations from our readers to keep going. With your help, we expose the mainstream fake news agenda.

Keep your language polite. Readers from many different countries visit and contribute to Free West Media and we must therefore obey the rules in, for example, Germany. Illegal content will be deleted.

If you have been approved to post comments without preview from FWM, you are responsible for violations of any law. This means that FWM may be forced to cooperate with authorities in a possible crime investigation.

If your comments are subject to preview by FWM, please be patient. We continually review comments but depending on the time of day it can take up to several hours before your comment is reviewed.

We reserve the right to delete comments that are offensive, contain slander or foul language, or are irrelevant to the discussion.

The inflation hoax

Yes, prices are rising, but not for the reasons the Federal Reserve says. When I say inflation is a hoax, I mean the purported cause is a hoax. The Fed is fighting a consumer inflation, a “demand-pull” inflation. But what we are experiencing is a supply-side inflation caused by the Covid lockdowns and economic sanctions that closed businesses, disrupted supply chains, and broke business relationships while reducing energy supplies to the UK and European countries, thus forcing up costs in a globalized economy.

Two-Party Pox: The Republicans suck and the Democrats want to kill you

The Republican Party has never stood up for Americans, will never stand up for them and is not going to do what it takes. Past is prologue.

Russia’s loss at Kharkov highlights crippling shortage of men

KharkovThe frontline in this case relied on heavily outnumbered 2nd rate Lugansk draftees plucked from the LPR.

A country without an honest media is lost

For some time I have reported to you that in place of a media, a media that our founding fathers relied on to protect our society, the United States has had a propaganda ministry whose sole purpose is to destroy our society.

Sweden’s decaying democracy

A journalist is arrested and dragged out of the Gothenburg Book Fair because he politely asked a powerful politician... the wrong questions about his support for the ethnically-cleansed Zimbabwean dictatorship. Not only journalists, but academics and bloggers are being hounded by the leftist establishment daily. And the leftists have all the nasty instruments of the state at their disposal. Citizen reporter Fabian Fjälling looks into their excesses.

The geopolitical future of Nordic countries

Between unity and disunity, independence and foreign interference: Nordic countries have to either choose between creating an independent neutral block in the North, or seeing the region being divided between the great powers.

Russian, Chinese intelligence: ISIS heading for Central Asia with US cover

Operatives of the crumbling Islamic State in Syria and Iraq (ISIS) are moving to new battlegrounds near the Russian border, intelligence sources have revealed.

The unraveling of US/Russian relations

Washington has taken nuclear war against Russia from a hypothetical scenario to a real danger that threatens the future of humanity.

Hero commander killed in Syria – when the war is nearly won

For most Syrians it came as a shock: One of the most popular military commanders of the Syrian Arab Army, Issam Zahreddine, was killed on 18 October 2017.